Our Feie Calculator PDFs

Table of ContentsOur Feie Calculator StatementsOur Feie Calculator IdeasSome Known Factual Statements About Feie Calculator How Feie Calculator can Save You Time, Stress, and Money.Excitement About Feie Calculator

He marketed his U.S. home to establish his intent to live abroad completely and used for a Mexican residency visa with his spouse to assist fulfill the Bona Fide Residency Examination. Furthermore, Neil secured a lasting property lease in Mexico, with plans to ultimately acquire a property. "I presently have a six-month lease on a residence in Mexico that I can prolong an additional six months, with the intention to buy a home down there." Nonetheless, Neil explains that purchasing home abroad can be testing without initial experiencing the location."We'll most definitely be outdoors of that. Even if we return to the US for medical professional's appointments or company telephone calls, I question we'll spend greater than thirty days in the US in any type of given 12-month duration." Neil highlights the relevance of stringent tracking of U.S. visits (Taxes for American Expats). "It's something that individuals need to be truly persistent about," he states, and encourages expats to be careful of usual mistakes, such as overstaying in the united state

Some Known Incorrect Statements About Feie Calculator

tax commitments. "The reason why united state taxation on worldwide earnings is such a huge offer is since numerous individuals neglect they're still subject to U.S. tax obligation even after moving." The united state is among the few nations that taxes its people regardless of where they live, implying that even if a deportee has no revenue from U.S.

tax obligation return. "The Foreign Tax obligation Credit score permits individuals working in high-tax nations like the UK to counter their united state tax obligation by the quantity they've already paid in taxes abroad," says Lewis. This guarantees that expats are not strained two times on the same revenue. However, those in low- or no-tax nations, such as the UAE or Singapore, face added obstacles.

How Feie Calculator can Save You Time, Stress, and Money.

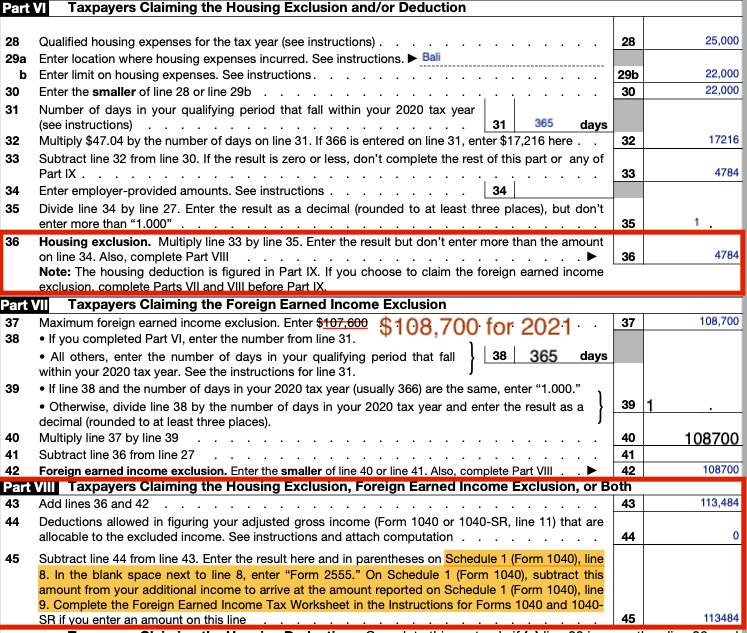

Below are some of the most often asked concerns regarding the FEIE and other exclusions The Foreign Earned Earnings Exemption (FEIE) allows U.S. taxpayers to omit approximately $130,000 of foreign-earned income from federal earnings tax obligation, reducing their U.S. tax liability. To get approved for FEIE, you should satisfy either the Physical Existence Test (330 days abroad) or the Bona Fide Residence Examination (show your key house in an international nation for a whole tax year).

The Physical Existence Test also needs U.S (Form 2555). taxpayers to have both a foreign revenue and a foreign tax home.

The Definitive Guide for Feie Calculator

An income tax treaty in between the U.S. and one more country can aid avoid double taxes. While the Foreign Earned Income Exclusion minimizes taxed earnings, a treaty might offer added benefits for eligible taxpayers abroad. FBAR (Foreign Savings Account Record) is a needed declare U.S. residents with over $10,000 in international economic accounts.

Eligibility for FEIE relies on conference details residency or physical visibility tests. is a tax consultant on the Harness platform and the owner of Chessis Tax obligation. He is a member of the National Association of Enrolled Brokers, the Texas Society of Enrolled Professionals, and the Texas Culture of CPAs. He brings over a years of experience functioning for Big 4 firms, advising expatriates and high-net-worth individuals.

Neil Johnson, CPA, is a tax expert on the Harness system and the creator of The Tax obligation Guy. He has more than thirty years of experience and currently focuses on CFO solutions, equity payment, copyright taxation, marijuana taxation and divorce associated tax/financial planning issues. He is an expat based in Mexico - https://www.quora.com/profile/FEIE-Calculator.

The foreign made income exclusions, sometimes referred to as the Sec. 911 exclusions, exclude tax obligation on wages made from functioning abroad.

More About Feie Calculator

The tax obligation benefit excludes the income from tax obligation at lower tax obligation rates. Formerly, the exemptions "came off the top" minimizing earnings subject to tax at the leading best site tax obligation rates.

These exclusions do not exempt the salaries from US taxes however simply give a tax obligation decrease. Note that a solitary individual working abroad for every one of 2025 who gained regarding $145,000 without any other revenue will certainly have gross income decreased to absolutely no - successfully the exact same answer as being "tax obligation cost-free." The exclusions are calculated daily.